今日のめまぐるしく変化する世界では、経済的な安定を達成することはすべての人々の夢です。誰もが長期的な経済的利益を求めています。今はデジタル効率の時代です。人々は成功するためにデジタルの世界で卓越することに興味を持っています。

経済的成功を得るための最も人気があり、利益率の高い手段の 1 つはトレーディングです。過去数年間、トレーディングは森の中の火のように広まっています。トレーディングは高い経済的利益を得るための最速の方法であるため、誰もがその魅力にとりつかれています。

しかし、トレードでは、成功と大きな損失の比率はほぼ 50:50 です。これは、トレードが多忙な仕事だからです。トレードは多くのストレスを引き起こし、トレードを実行するために高い効率性を求めます。従来のトレード方法は、トレード タスクを実行する際に人間の欠点が含まれるため、もはや効果的ではありません。

ここで AI が登場します。AI は、確立されたテクノロジーを使用して、人々がより効率的に取引を行えるようにします。金融市場には、AI 取引ソフトウェア システムが導入されています。これらのソフトウェア システムは、最新の AI テクノロジーに従ってプログラムされています。

AI 取引ソフトウェア システムではどのようなテクノロジーが機能しますか?

AI は、機械学習アルゴリズムの原理に基づいて動作します。機械学習アルゴリズムは、AI が特定のタスクを実行するように導く数学的値のセットです。これらのタスクには、何千ものデータセットを調べ、過去のパターンを観察して有用な洞察を得ることが含まれます。その後、以前に分析されたパターンに基づいて予測を行います。

これらすべてのタスクは取引の中核となる活動です。効果的な取引は、本物の市場データを入手して初めて実行できます。

AI 取引ソフトウェア システムは、AI テクノロジーで動作するように特別に作られています。

これらのアプリケーションで使用される AI テクノロジーの信頼性により、取引に使用する価値が高まります。

これらの AI 取引ソフトウェアでは、自然言語処理も使用されています。NLP の役割は、難しい金融情報を、理解しやすい言語に変換することです。この金融データには、簡単な言語に変換されるチャットや音声データが含まれます。NLP は、人間の言語データを分析するために、ディープラーニング技術を使用します。

AI トレーニング アプリの背後で機能する主要なテクノロジーについて説明しましたが、次はこれらの AI 取引ソフトウェアの重要な機能について学習します。

株式市場取引用の AI 取引ソフトウェアに付加価値を与える機能は何ですか?

AI 取引ソフトウェアには、さまざまな取引機能を実行するための数多くの魅力的な機能があります。ここでは、株式市場取引用の AI 取引ソフトウェアの重要な機能について簡単に説明します。

- AI 取引ソフトウェアは、自動的に取引を実行できます。事前定義されたルールと、慎重な市場分析を通じて収集したデータを使用します。取引の実行にユーザーの手助けは必要ありません。

- 取引ソフトウェアは何千ものデータポイントをチェックできるため、株式市場の取引に非常に有効です。人間が短時間で膨大な量のデータを調べることはできないため、従来の取引ではこれは困難です。

- これらの AI 取引ソフトウェアは、あらゆる潜在的な取引機会に対してカスタマイズ可能なシグナルアラートを生成します。これにより、取引を通じて利益を上げるチャンスが無駄にならないようにします。

- これらのソフトウェアは、金融市場の将来の傾向を予測するのに優れています。これは、市場データの過去と現在の変動を分析するからです。この分析により、市場で次に何が起こると予想されるかを把握できます。その後、それに応じて取引の計画を立てることができます。

- これらの AI トレーディング ソフトウェアは、トレーディング プランのバックテスト機能を提供します。この機能を使用すると、トレーディング プランの可能性を確認できます。プランがうまく機能する場合はそのまま実行し、うまく機能しない場合は変更する必要があります。

- AI 取引ソフトウェアの最も重要な機能の 1 つは、その高速性です。リアルタイムのデータを数ミリ秒単位で分析できます。これは、わずかな取引のチャンスでも利益を得るのに非常に役立ちます。

- AI 取引ソフトウェアは、システム内のブローカーを統合して、直接取引の実行を可能にしました。これにより、注文を出すための時間と手作業を節約できます。

- 信頼できる規制当局によって規制されているこの取引ソフトウェアは、取引の高度なセキュリティを保証します。2 要素認証を通じてデータと個人情報を保存します。

AI 株式市場取引に最適なソフトウェア システムは何ですか?

ここでは、株式市場取引のトップ トレーディング ソフトウェア システムのいくつかをレビューします。

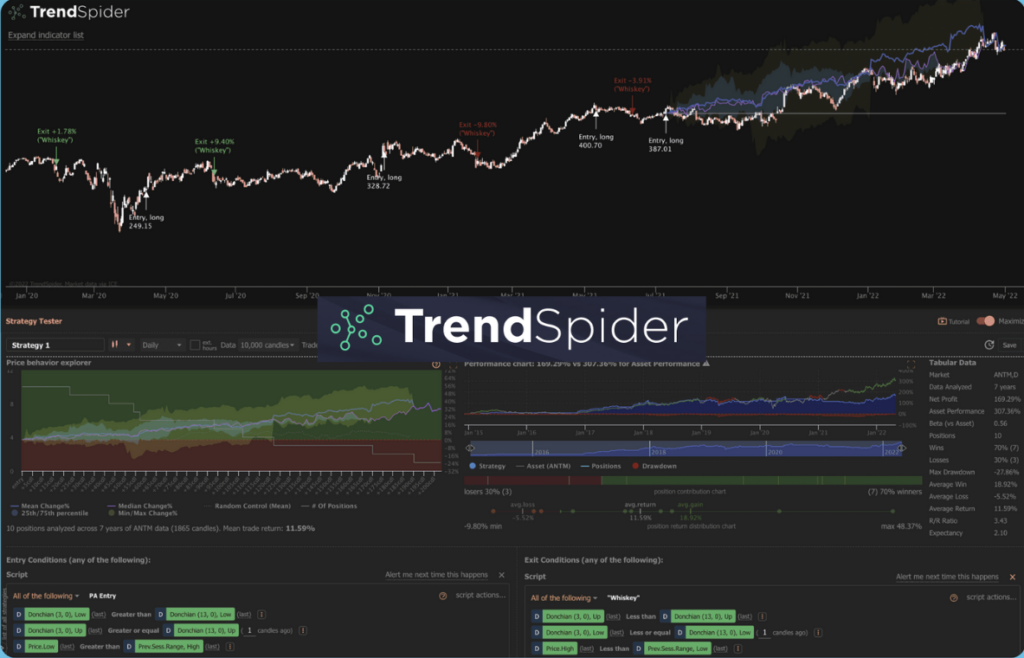

トレンドスパイダー

このプラットフォームは、優れたチャート作成機能と市場分析機能で特に知られています。短時間で真の市場洞察を得たいなら、このプラットフォームが最適です。

長所:

- 取引を自動化します

- 価値あるチャートを備えたインターフェース

- 効果的なバックテスト機能

短所:

- 高コスト

- トレーダーにとって難しい学習教材

AIトレーダー

AI Trader はトレーダーの間で人気が高まっている、最高のトレーディング プラットフォームの 1 つです。初心者に優しいプラットフォームで、簡単に取引できます。初心者トレーダーにとって、これはトレーディングの旅を始めるための「頼りになる」プラットフォームです。

長所:

- 使いやすいインターフェース

- 初心者に優しいが、あらゆるレベルのトレーダー向け

- 取引を始めるための投資資金が非常に少ない

- 複数のデジタル資産の取引を容易にする

短所:

- 市場における突然の価格変動を検出できない可能性がある

- 即座に判断を下すための人間の知能が欠如している

トレードアイデア

この AI トレーディング ソフトウェアは、総称して「Holly」と名付けられた 3 つのトレーディング ボットで最もよく知られています。これらのボットには、市場の膨大な株式を分析するための 70 種類の異なる戦略が搭載されています。

長所:

- さまざまな取引戦略を提供します

- 独自の機能を備えた3つのAIトレーディングボットがあります。

- 取引を直接自動化できる

- トレーダー間の学習を促進するコミュニティがある

短所:

- 教育教材のロックを解除するには投資が必要です

- ユーザーに隠れたコストを押し付けるため、コストが高い

トレーディングビュー

このプラットフォームは、さまざまなテクニカル分析ツールを提供することで最もよく知られています。トレーダー向けのソーシャル プラットフォームを備えているため、世界中のトレーダーが参加しています。カスタマイズ可能なインジケーターも提供しています。

長所:

- 世界中のトレーダーを結びつける大きなユーザーコミュニティがあります。

- 無料プランも提供

- ユーザー指向のインターフェースを備えています

短所:

- 有料プランもいくつかある

- 徹底した市場分析を提供しない

シンカースイム

この AI 取引ソフトウェアには、何百ものローソク足パターンを分析するための最適なツールが搭載されており、大量のデータを瞬時にふるいにかけることができます。

長所:

- 取引を行うための最高のツールを備えています

- 複数の資産を取引する機能を提供します

- 高度なチャート、分析、ペーパートレーディング機能を備えています

短所:

- 複雑なインターフェースを持っています

- 多様な支払い方法の選択肢を提供していない

結論

市場にはさまざまなトレーディング アプリが存在するため、AI トレーディング ソフトウェアの選択は非常に難しい場合があります。ソフトウェアを選択する際には、考慮すべき特定の要素があります。まず、トレーディングの好みを把握し、次に自分に最も適していると思われるソフトウェアを選択する必要があります。

常に、株式市場取引を容易にする AI 取引ソフトウェアを選択してください。複雑なインターフェースや高額な投資資本は必要ありません。最新の取引ツールとテクノロジーを備えている必要があります。これにより、最新の市場動向に従って取引が行われることが保証されます。

当社の AITrader ソフトウェアには、取引を成功させるために必要なすべての機能が備わっています。これ以上考える必要はありません。当社のソフトウェアの洗練された ML アルゴリズムを活用して、簡単に最大の取引利益を獲得してください。